SENIOR LIVING INVESTMENTS – CASE STUDY

- Acquired a facility in Santee, SC in October 2017 for $1.9MM

- Completed a cash out refinance in October 2018 at 3.8X appraised value from 12 months prior

- Initial Investment: $500K – Withdrew $2.2MM upon refinancing

- Exited January 2020 at $5.8MM

- >7x total cash on cash ROI

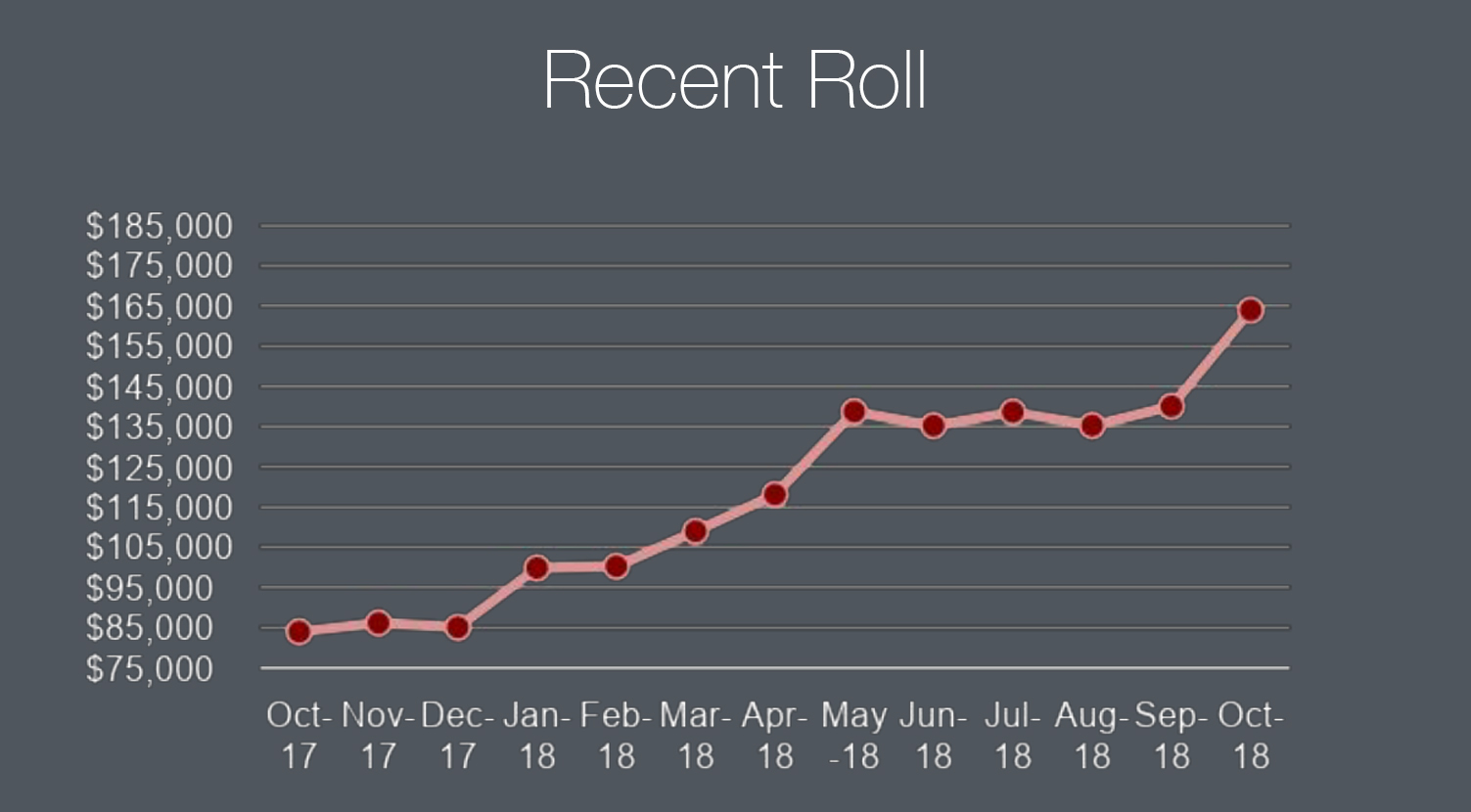

Increased facility rent roll from $82K upon acquisition to $158K 12-months later.